Thinking about doing your taxes yourself?

Many individuals, business professionals, and companies go the DIY route.

When tax time rolls around, they renew the license on their tax preparation software; dive headfirst into the sea of the forms, credits, and write-offs; and attempt to make doing their taxes as quick and pain-free as possible.

In some situations the DIY approach works. For example, if your tax situation is really basic—W-2 employees who opted for adequate tax withholding, for example—then a CPA won’t have find many opportunities to improve your situation and provide value.

But as the economy has changed, so has tax legislation. Those changes make the DIY route less viable for more and more business professionals. In most cases, attempting the DIY route will cost you more money than it saves you.

So why do people do their own taxes?

Most people don’t enjoy doing the actual work. And if you asked them, they probably agree that a CPA would prepare the tax return better and faster.

What’s the missing word? Cheaper.

Even if hiring a professional to prepare your taxes will put your mind at ease, it is not less expensive. Paying for someone with experience and specialized training to perform a complex task like tax preparation never is.

Some people would prefer to grit their teeth and do the job themselves. They pay a nominal fee to use TurboTax (or similar software), but the total cost should still be less than paying a CPA.

In short, you can save money by not hiring a CPA to do your taxes.

But what are the hidden costs?

Culpepper CPA does quite a bit of “salvage” work. People come to us after the DIY route has proven ineffective. Our job then becomes to clean up the mess and then help the client pacify the IRS.

We’ve had a front-row seat on enough DIY-gone-wrong situations to tell you definitively that DIY tax prep can come back to bite you.

Let’s explore some of the hidden costs.

#1 – Missed Write-Offs

When you overlook write-offs, your taxable income is higher. You end up owing more in taxes.

Not only do you overpay Uncle Sam, but you also miss out on the enjoyment of the cash in hand, or the future impact those dollars might have had as an investment.

Benjamin Franklin once said, “There are three faithful friends: an old wife, an old dog, and ready money.” Say what you will about the first two, but you can’t disagree with the third!

On the other hand, the less you are required to pay in taxes, the more cash your business keeps. The more cash you have on hand, the greater your capacity to pay down debt, invest, or double down on your business with new equipment, people, products, or opportunities.

Why do so many individuals and companies hire trained professionals to help minimize their tax burdens? Because the immediate cost of accountants is worth the long-term value they create. CPAs spend years familiarizing themselves with tax code and learning smart tax avoidance strategies. (Note: Tax avoidance is legal. Tax evasion is not.)

Business owners pay CPAs to track down every possible write-off so that they end up owing less in taxes. This creates a virtuous cycle: more ready cash becomes richer soil for growth.

#2 – Lost Time

For most professionals the resource that needs stewarding the most is time.

You can create time by offloading your tax preparation and tax management. If you use your time instead to create value in your business—for example, with sales, marketing, business development—then you can more than offset accounting and tax preparation fees.

You pay for a bit more freedom, and in so doing, you put yourself in a better position to grow your business.

#3 – No Peace of Mind

Your freedom has tremendous value even before you factor in what mistakes or an audit might have cost you.

One way tax professionals create value is by bringing peace of mind. You don’t have to wonder if you are missing out a chance to minimize your tax burden. You don’t need to worry about penalties, mistakes, or any issues related to noncompliance.

The peace of mind that CPAs provide comes at no additional cost. One way or another, you have to prepare your taxes, but when you pay us to do something that has to be done anyway, you may end up saving time and money and headaches.

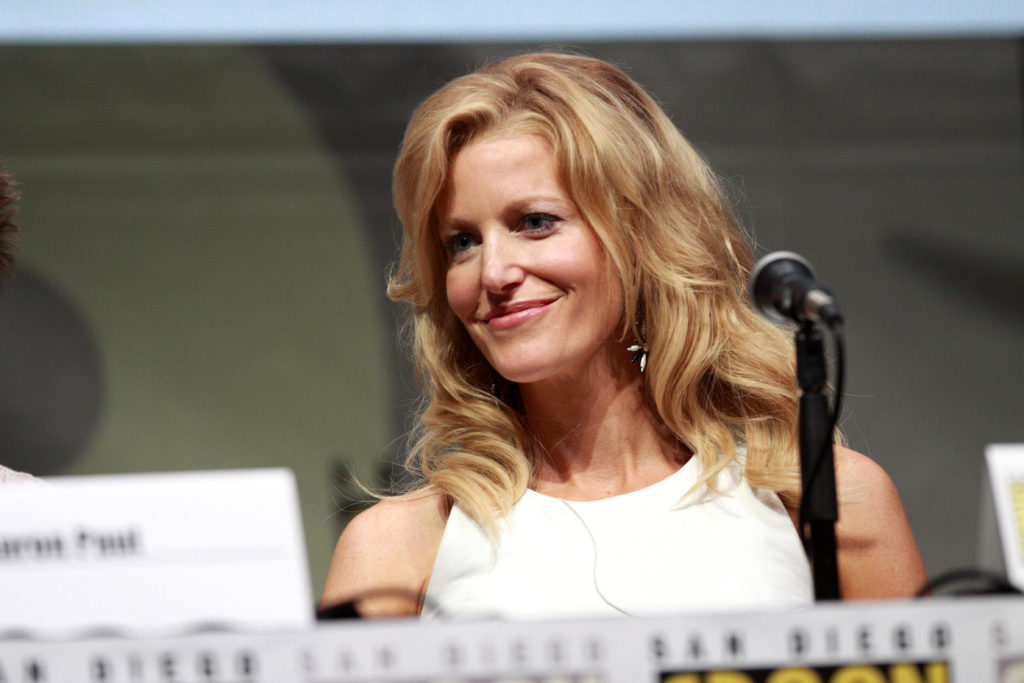

Don’t be Skyler White

There’s this great scene in AMC’s Breaking Bad where one character named Skyler White plays dumb in an attempt to cover up embezzlement: “When I put everything into the Quicken it didn’t flash red, so that means it’s okay, right?”

So don’t be a Skylar White. The IRS won’t buy the “misinformed tax software user” act, and you’ll wish you’d done your taxes the easy way—that is, by hiring a CPA.