by Todd Culpepper | Mar 20, 2018

As a CPA, I obviously think about investments a lot, and I also get many questions from clients about the most common investing mistakes, as well as the best tax strategies for managing investments. How you handle your investments from a tax standpoint can obviously...

by Todd Culpepper | Mar 1, 2018

2017 ended with a lot more than champagne and fireworks. Recent tax changes wreaked havoc on a lot of people’s business planning. The House of Representatives and Senate reconciled their two versions of the Tax Cuts and Jobs Act, and on December 22, the...

by Todd Culpepper | Jan 23, 2018

2017 ended with a bang from a tax perspective. The Senate and House of Representatives were able to reconcile their two versions of a new tax bill, and on December 22, 2017 President Trump signed into law the biggest changes to tax in over 30 years. Regardless of how...

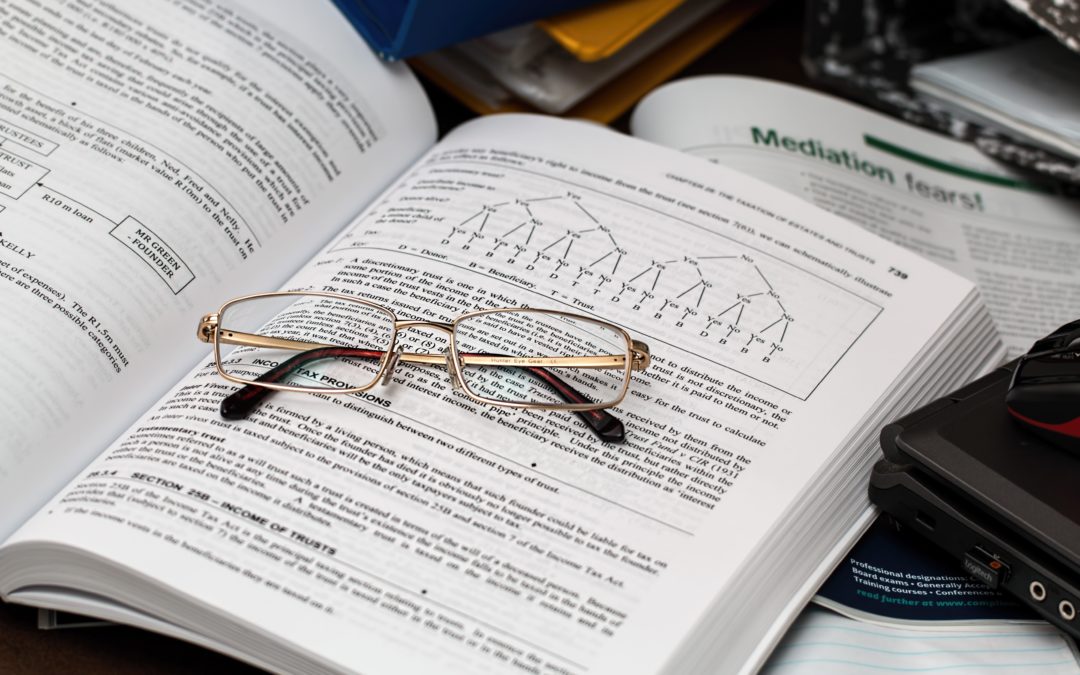

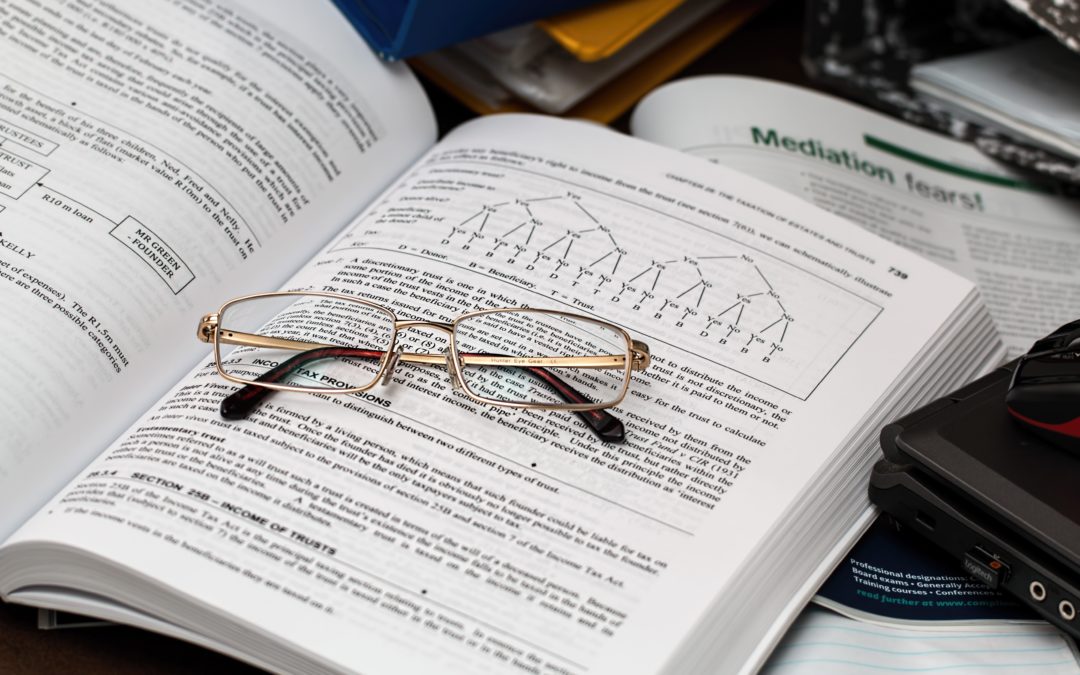

by Todd Culpepper | Oct 18, 2017

Halloween is right around the corner, so we’ll tell you a scary story. The story begins with… your finances. Are you nervous yet? That word “finance” makes a lot of people squirm, and the story usually goes something like this: A small business owner avoids digging...

by Todd Culpepper | Oct 11, 2017

It’s a digital age. We rely on computers, apps, and machines to do things our parents (or we) used to do by hand. You may have a mother-in-law who still balances her checkbook after every check she writes. Well, before you tell her not to worry about that step, you...

by Todd Culpepper | Sep 6, 2017

The majority of Americans think about paying taxes only when tax season rolls around—sometime between January 1 and that year’s filing deadline. That works for salaried or hourly employees if their companies automatically take out taxes every pay period, but what...

by Todd Culpepper | Aug 11, 2017

Dealing with finances is inevitable. Whether on behalf of a business or your family, at some point you’ll have to wade into the murky waters of taxes, accounting, or investments. Unless you like to memorize tax code for fun, it’s probably a good idea to hire an...

by Todd Culpepper | Jul 7, 2017

Are you thinking about converting your traditional IRA into a Roth IRA? You don’t have to do much research before you realize that the process is clear as mud. Let’s bring some clarity to the situation. The benefits of converting an IRA depend upon several factors...

by Todd Culpepper | Jun 26, 2017

Forensic accounting can bring clarity and peace of mind to a variety of delicate situations. Maybe you’re worried that you or your business have been the victim of fraud and you need an expert to examine your books and figure out what really happened. Perhaps you...

by Todd Culpepper | Apr 11, 2017

At Culpepper CPA we find ourselves working often with new business owners, many of whom are self-employed for the first time. As you can imagine, we field many questions about self-employment tax, estimated tax payment penalties, and the transition from W2 income to...