by Todd Culpepper | Feb 12, 2020

Running your own small business is hard enough. We’ve written down some of our best tax-saving strategies so you can get the best for your business when tax season comes around. Start saving for your retirement. We get it: being an entrepreneur is a huge...

by Todd Culpepper | Nov 22, 2019

“You know what I want to do today? Call up the IRS,” said no one, ever. I know, I know. Dealing with the IRS is never fun. It’s even less fun when you have tax problems at hand. These issues could stem from a simple mistake on your part or on theirs. Maybe you’ve...

by Todd Culpepper | Feb 28, 2019

For most Americans, the date of April 15th is almost as recognizable as December 25th. But while Christmas means joy, celebration, and peace, Tax Day often means stress and anxiety. Many people spend a lot of the year dreading Tax Day. Because of this, plenty choose...

by Todd Culpepper | Nov 27, 2018

When starting and managing a business, you have to decide what form of business entity to classify yourself as. The business entity you choose will shape the path of your small business more than you may realize. Choosing the right structure for your company can have...

by Todd Culpepper | Oct 30, 2018

Small businesses account for 99.7% of U.S. employer firms. Needless to say, any development that impacts small businesses is worth paying attention to. Enter the Tax Cuts and Jobs Act (TCJA). Passed in December 2017 and effective (for the most part) on January 1,...

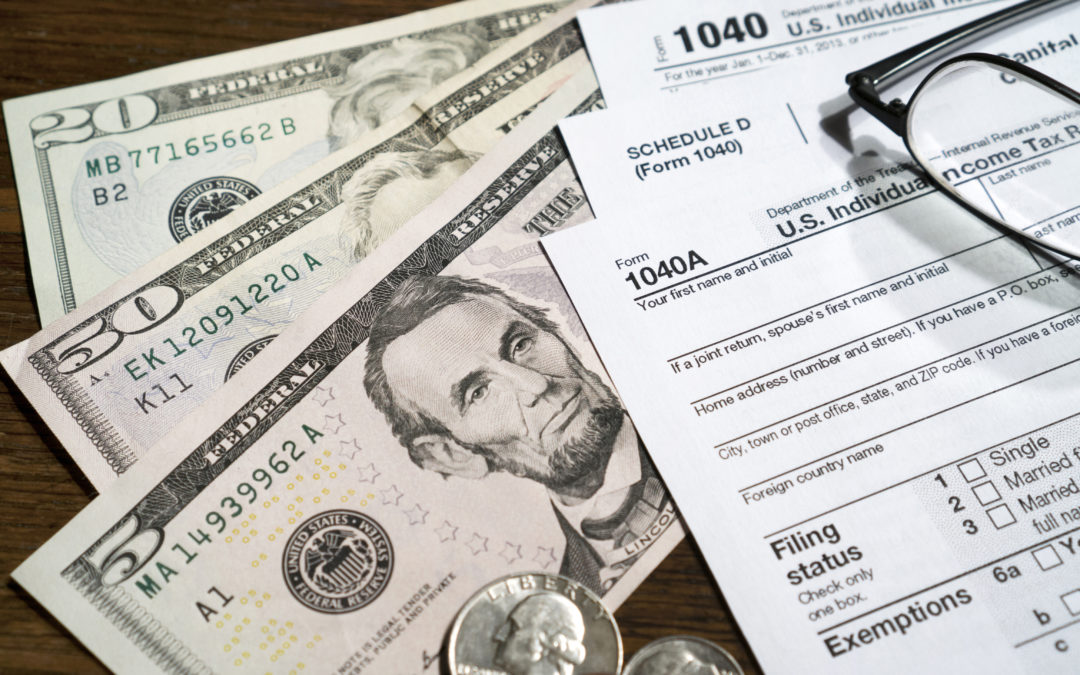

by Todd Culpepper | Mar 1, 2018

2017 ended with a lot more than champagne and fireworks. Recent tax changes wreaked havoc on a lot of people’s business planning. The House of Representatives and Senate reconciled their two versions of the Tax Cuts and Jobs Act, and on December 22, the...